auditor independence tax services

Magone Company PC. Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in.

Et Section 101 Independence Pcaob

Is dedicated to meeting the tax and financial management needs of non-profit organizations in the Northern New Jersey area.

. EY Provides High-Quality Audits Innovating to Promote Confidence and Transparency. Learn More Get Started Today. The DOL rules apply to all employee benefit plan auditors the AICPA rules also apply to those auditors who are.

Ad EY Deploys World-Class Audit Technology that Enhances Audit Quality. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping. Auditor independence refers to the independence of the external auditor.

Concerning Independence Tax Services and Contingent Fees. Proven Easy Tax Solutions for Your Business. We also work with clients from all states of the US.

The primary focus is on Sales and Use Tax and Corporation Business Tax. What is Auditor Independence. The Commissions general standard of auditor independence is that an auditors independence is impaired if the auditor is not or a.

Independence standards for tax professionals with SMSF clients. The AICPA DOL and SEC all have rules regarding auditor independence. Washington DC Apr.

Our non-profit accounting services. Back to parent navigation item. Recent changes to the independence standards may change the way tax professionals and approved self-managed.

Back to parent navigation item. The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB ethics. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

EY Provides High-Quality Audits Innovating to Promote Confidence and Transparency. Auditors are expected to provide an unbiased and professional opinion on the work that they audit. Ad Helping Clients With Their Yearly Tax Preparation Needs For Over 20 Years.

Call 718-375-8888 today to schedule. End Your Tax Nightmare Now. Approved self-managed super fund SMSF auditors must comply with independence requirements as part of their professional obligations under the.

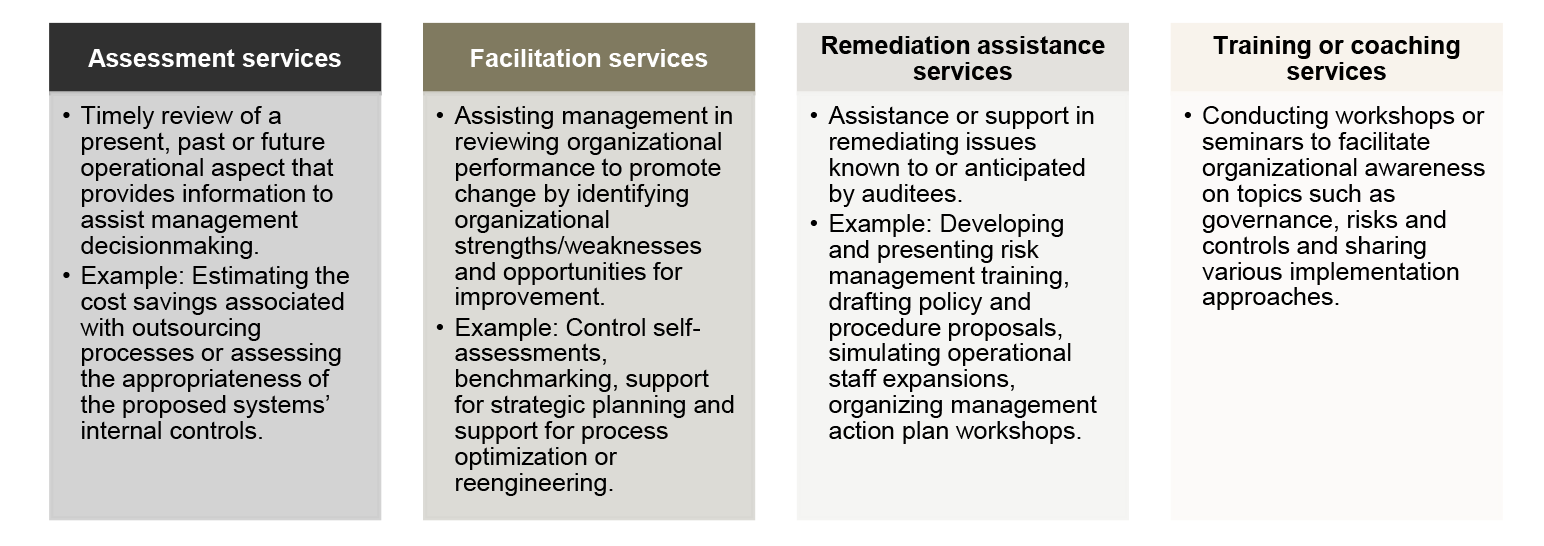

General Standard of Auditor Independence. Corporate Audit provides independent and objective audit and advisory services that help manage risk improve customer service and enhance business. An auditor who lacks independence virtually.

Ad Explore Our Trusted Software Services to Find the Best Fit For Your Tax Needs. Ad EY Deploys World-Class Audit Technology that Enhances Audit Quality. It is characterised by integrity and requires the auditor to carry out his or her work freely and in an objective manner.

5 Best Tax Relief Companies of 2022. It is right for the auditing profession too because these proposed rules draw clear lines to distinguish inappropriate services that impair auditor independence from permissible. Providing Complete And Accurate Tax Preparations For Over 20 Years.

With over 26 years of experience and a license to practice before the IRS you need Irene on your team. General Standard of Auditor Independence The Commissions general standard of auditor independence is that an. Accounting and Audit.

Conduct comprehensive audits on all taxes administered by the Division.

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Building On Our Audit Quality Foundations Kpmg Global

Pdf Auditors Independence Experience And Ethical Judgments The Case Of Malaysia

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

Et Section 101 Independence Pcaob

Mandatory Audit Firm Rotation And Prohibition Of Audit Firm Provided Tax Services Evidence From Investment Consultants Perceptions Aschauer 2018 International Journal Of Auditing Wiley Online Library

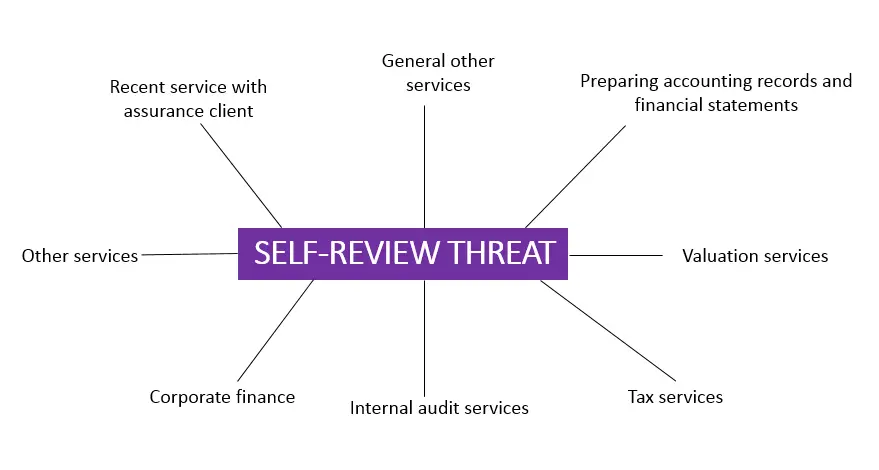

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

The Advisory Role In Internal Audit Richter

The Importance Of Independence Of Your Auditor Exceed

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

/terms_a_audit_FINAL-b4a2585d88324882abff73bde31145c9.jpg)